Vol. 22 No. 8

Executive Summary

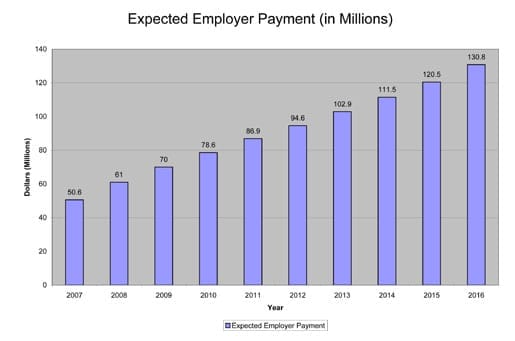

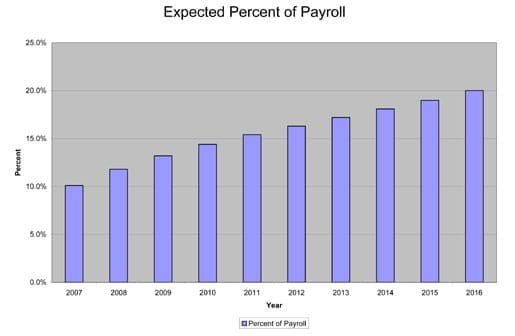

The cost of health insurance for retirees has become a heavy burden for the Milwaukee Public Schools (MPS) budget and will worsen significantly in the next few years. MPS currently has a pay-as-you-go policy of funding retiree health insurance benefits, which will cost approximately $70 million in 2009 and grow to over $130.8 million, or 20% of payroll costs, by 2016. These costs are a major contributor to MPS’s fringe benefits rate of 68.7%, the highest among 33 peer institutions in the Midwest.

The unfunded liability for these health care costs, i.e., the estimated costs of future health care insurance benefits for retirees that MPS has promised to pay but has not set aside money for, now stands at $2.6 billion, more than double the district’s entire annual operating budget. These costs will ultimately be borne by Milwaukee taxpayers, and, because of the state school funding formula, taxpayers statewide.

Part of the reason for the size of the liability is that retiring MPS staff who qualify for the program are ensured a lifetime subsidy to pay for health insurance. In 2008, the subsidy was up to $1,882 monthly for family coverage or $851 monthly for single coverage. Unlike pensions, which typically link benefit levels to time on the job, MPS provides the same monthly health insurance benefits to all retirees who meet the criteria, even those who retire as early as age 55 and work for MPS for as few as 15 years. The average age of a retiring MPS teacher is 57 years old. In fact, workers who retire early receive more in total health insurance benefits than those who retire closer to age 65 because the younger retirees collect the maximum benefits for more years before they qualify for Medicare.

Health insurance benefits for retirees were first granted to MPS teachers and staff as part of their 1973-74 bargaining agreements with the district. However, rather than budget for these new costs by pre-funding them, similar to the standard practice of pre-funding pension costs, the district chose the pay-as-you-go method. Failure to anticipate today’s large liabilities may have been understandable in the early 1970s, when health insurance costs were a considerably smaller portion of total compensation costs. However, by 1989, the Milwaukee Board of School Directors was warned by its actuarial consultants that future liabilities would explode to today’s current levels without board action to begin pre-funding. However, the MPS board in 1989 and all succeeding boards failed to act to stem the growing liability. As a result, the ultimate cost to the taxpayer will be three times what it would have been if the benefit had been pre-funded because pre-funding, such as is done with pensions, allows investment earnings to cover two-thirds of ultimate costs.

In 1989, when the actuaries first warned the board of the consequences of not pre-funding the benefit, the unfunded liability for retiree health insurance stood at $202.5 million. Since no action was taken by the board, by 2009 the unfunded liability has grown to $2.6 billion. In 2007, the board was again warned in another actuarial study of the continuing growth of the unfunded liability, but once again the board chose to take no action.

Milwaukee School Board President Michael Bonds, in an interview for this study, indicated his concern over the growing liability. However, Bonds indicated that he believed the choice between the current pay-as-you-go budget approach and pre-funding, as recommended by the actuaries, was a staff rather than a board decision. Bonds further indicated that any attempts to implement cost-control mechanisms on health care costs that would be considered benefit changes would be a matter of contract negotiations with MPS employee unions. Bonds said that, to his knowledge, there were no plans by the board to address the unfunded liability.

The most important consideration of potential decisions to address or continue to ignore the unfunded liability is the potential effect on the classroom. MPS finds itself in a catch-22 situation. Pre-funding of retiree health insurance benefits would add $125 million to the annual budget. This equates to the estimated costs of 1,625 teachers and is more than double the 2009 budgeted costs, for instance, of all MPS middle schools combined. Therefore, in the short term, not pre-funding retiree health insurance costs may appear to be a prudent decision. However, from a long-term perspective, continuing the current pay-as-you-go approach will result in retiree health insurance costs growing from $70 million in 2009 to $130.8 million in 2016, and the total unfunded liability growing from the current $2.6 billion to over $4.9 billion. Consequently, doing nothing takes money out of the classroom even in the short term. In the long term, doing nothing could profoundly limit the district’s resources available for the classroom.

It took years for the unfunded liability to grow to its current size, and it may take years of effort by MPS to reverse that growth trend. However, any delay in addressing the liability will only exacerbate the problem. Actions recommended in this study are:

- MPS could immediately and definitively move to implement the cost-saving recommendations of the McKinsey Report on district operations.

- MPS should reduce the cost of health benefits offered to active and retired employees through measures such as establishing greater cost-sharing requirements with employees and bringing the costs of its high-cost PPO plan more in line with its HMO plan.

- MPS should begin budgeting for the future health insurance costs of current employees in the same way it budgets for current employees’ future pension costs.

- MPS should determine what changes can be made to reduce the cost of health care for current retirees within the framework that courts have placed on retiree benefit changes.

In addition to MPS-initiated changes, some action by state government might be necessary to address large unfunded liabilities at MPS and potentially at other school districts. While MPS alone is responsible for creating its unfunded liability, the state constitution does assign responsibility for education to state government, which must understand the damaging effect the $2.6 billion unfunded liability could have on Milwaukee’s children. First, state government should establish limits on the amount of unfunded liability for retirement benefits such as health insurance that school districts could accumulate, similar to how the state currently limits school districts’ annual spending increases and debt levels. Second, state policymakers should assess what the appropriate state role is in addressing specific local school issues like MPS’s unfunded liability.

Introduction

At a time when public debate and confusion continues to rage over the potential costs of universal health insurance and especially how such costs may be funded, it may be instructive to consider the dire straits in which Milwaukee Public Schools currently finds itself–on the hook for over $2.6 billion for just retiree health costs, an amount larger than a full year’s annual operating budget. MPS’s unfunded actuarial liability (UAL), reported by its actuary in 2007, is an estimated $2.6 billion for fiscal year 2009-2010, and projected to grow to $4.9 billion by 2016.1 The unfunded liability represents the estimated costs of future health insurance benefits for retirees that MPS has promised to pay.2 The liability is unfunded in that MPS has set aside no funds to pay for these costs when they come due. As a point of comparison, while there are concerns at the national level that at some point in the future the Social Security Trust Fund will shrink and be unable to pay all promised benefits, MPS has not established a trust fund nor built up any assets whatsoever to pay its promised retiree benefits.

How to climb out of such a hole, or at least stop it from getting deeper and deeper, as the current actuarial projections predict will happen, is a focus of this study. Any consideration of this problem must include an assessment of the effect on the students and taxpayers of MPS. Of equal importance to government policymakers, and especially to taxpayers who elect the MPS board, is gaining an understanding of the decisions made by the MPS board and staff that, over the years, created this situation.

*****

Origins of the Unfunded Liability

MPS pays for the health insurance of its current employees, and part of the cost of health insurance for many of its retirees. Such benefits are not inconsistent with those traditionally offered by other large public and private employers. The City of Milwaukee, Milwaukee County and the state of Wisconsin all provide health insurance to active employees and some level of benefits to retirees who meet certain eligibility requirements. Taxpayers may wonder how the commitment for retiree health insurance costs, which, on average, are considerably less than for active employees, could have grown to an amount that exceeds not only the entire annual salary budget at MPS, but indeed the entire MPS annual operating budget.

Table 1 shows the estimated growth of the unfunded liability made by MPS’s actuarial consulting firm in 2007. The annual required contribution shown in Table 1 represents the amounts MPS would need to pay for retiree health insurance premiums for each year, plus an extra amount it would need to set aside to gradually amortize the unfunded liability. In contrast, Table 1 also shows the payments expected to be made by MPS according to staff estimates.3

Table 1

| 7/1/2007 | 7-1-08 | 7-1-09 | 7-1-16 | |

| Unfunded Actuarial Liability | $2.2 B | $2.4B | $2.7B | $4.9B |

| Annual Required Contribution | $175.5m | $190.4m | $206.3m | $354.1m |

| Expected MPS Payment | $50.6m | $61m | $70m | $130.8m |

| Cumulative Shortfall | $124m | $254.3m | $390.6m | $1648.4m |

Retiree health insurance benefits, unlike pensions, are not pre-funded. Instead, they are charged against the existing fringe benefit budget for active employees. Portions of the large UAL come due each year and take up an increasing percent of the payroll budget, competing for annual funding increases with educational programs and compensation for active employees. The percent of the MPS payroll expected to be dedicated to retiree health insurance benefits is projected to increase from 10% in 2007 at the time of the valuation report, to 20% in 2016.

The $2.6 billion retiree health care deficit was born of two parents: 1) a succession of policy decisions dating from the 1970s to grant increased benefits to retirees; and 2) a series of management decisions to underbudget for known costs and to ignore explicit early warnings of the ever-growing financial problems. In hindsight, it is difficult to determine which of these causes contributed most to the current deficit. In today’s environment of heightened sensitivity to employee benefit packages, the policy decisions over the years appear overly generous. Recent studies by outside consultants have documented how employee benefits provided by MPS are generous compared to peers, and have suggested numerous ways of reducing operating expenditures.4

Of equal if not greater importance to the genesis of the UAL are the management decisions made over the years to underbudget for future costs and to ignore explicit warnings of the consequences of the underbudgeting. These conscious management decisions not only ensured the growth of the unfunded liability, they allowed the MPS board to continue to enhance benefits over the years without having to face the full cost implications of those decisions. Worse than buy now and pay later, it was buy now and let some future board face the bill.

The Age of Benefits Increases

The 1960s and early 1970s saw a wave of employee benefit improvements throughout much of the nation, especially with larger employers. The period is often considered the golden years of benefit expansion, especially for organized labor in both the public sector and the private sector. This extension of benefits in the labor market was consistent with federal policy developments, including the establishment of Medicare, enacted in 1966, providing universal health care coverage for those over the age of 65, the traditional age of retirement and full Social Security benefits for American workers.

Prior to the Great Depression of the 1930s, employee benefits in America were generally limited, offered by a small number of “enlightened employers.” However, after experiencing the poverty and social upheaval during the Great Depression, there developed an impetus after World War II to create and foster social mechanisms that would provide increased economic stability in the country. Federal tax policies explicitly encouraged the provision of health insurance benefits by private employers by making the costs tax-deductible for employers and tax-exempt for employees. As a result, health insurance benefits became a more cost-effective compensation tool for employers than salary increases as well as a tax-exempt form of compensation increases for employees. Further, the greater purchasing power of large employers allowed them to obtain health insurance coverage at lower per capita rates than individuals could purchase on their own. Finally, during the post-war years of economic expansion in America, improved employee benefits were an effective employee recruitment and retention method of companies competing for skilled workers.

Expanded employee benefits at the time were good social policy in that they provided for economic and social stability to a generation that had lived through the Great Depression, they were a tax-advantaged way for employers to increase overall compensation and attract workers, and they were a favorite of organized labor, which could bargain for increased benefits for their members.5

MPS Retiree Health Insurance Benefits

Health insurance benefits for retired teachers were first established in the 1973-74 teachers union (MTEA, Milwaukee Teachers Education Association) contract. Under the original terms, eligible teachers retiring in 1973 or later could remain in health insurance plans offered by the district to active teachers, and the district would pay the premium costs up to the amount it paid for the highest-cost plan at the time of the teacher’s retirement.6 The maximum amount paid would remain fixed throughout the teacher’s retirement years. Similar benefits were established for other MPS unions as well.

To be eligible for the health insurance benefits, retiring teachers (excluding those retiring on disability) must meet the following requirements: be age 55 or older, have 15 years of employment at MPS (originally 20 years) and have saved 812 hours of sick leave. A typical teacher at MPS has a 10-month contract and earns 100 hours of sick leave per year. Teachers with 11- and 12-month contracts earn 110 and 120 hours of annual sick leave, respectively.7

History of Expansion

It may be impossible to glean what MPS board members thought the long-term fiscal impact of the retiree health benefit program would be on the MPS budget. Indeed, based on the few MPS records still available from that time, including the Proceedings of the Milwaukee Board of School Directors, it is not clear how fully the board debated or considered the long-term cost of the new program apart from other employee benefits or compensation costs. Records from the meeting of the board in which the 1973-1974 teachers contract was approved indicate the board was presented with the total annual cost increase of the new contract, but with no information on the individual cost components of the new contract.8

In considering how the current multi-billion-dollar unfunded liability developed, it appears that changes in both the program and in society contributed to the growing shortfall. Eligibility rules were loosened, more employees were allowed to participate, and employees were covered for longer periods of time.

Since it was established in 1973, the board lowered the bar for one of the key eligibility criteria–the minimum number of years worked at MPS. In 1973, when the benefit was first granted, teachers and other MPS employees were required to have worked at MPS for at least 20 years in order to be eligible for the program. Since then, the employment tenure requirement has been reduced by 25%, to 15 years.

It also appears that while the number of hours of sick leave an employee was required to save in order to be eligible for the program increased, that increase was offset by allowing employees to earn “bonus” sick leave hours in addition to their standard 100 hours per year. Teachers who use zero to 16 hours of sick leave a year receive an incentive bonus of 16 additional hours of sick leave. Teachers who use 16 to 32 hours of sick leave per year receive an incentive bonus of eight additional hours of sick leave annually. In other words, a teacher who uses no sick leave during a year accumulates not only the contractual 100 hours, but is also given an additional 16 bonus hours for the following year, which may also be banked. Similarly, teachers may take two days of sick leave annually, and still effectively earn their maximum 100 hours per year, as 16 hours of bonus sick leave is added to their balance the following year.9 A further expansion occurred when MPS agreed to allow staff to convert sick leave hours that had been accrued at one-half the rate of pay to full rate in order to more easily qualify for the retiree health insurance benefit.10

Paying Benefits Longer

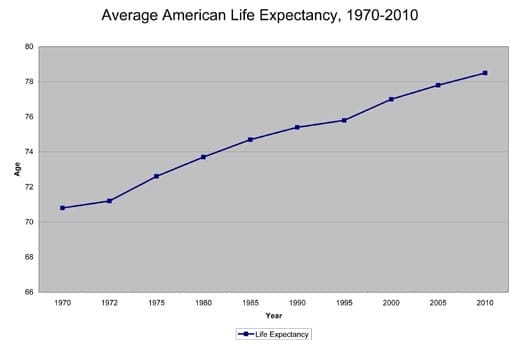

A key factor in the cost of any retirement program is, of course, how long members receive benefits. It is a harsh reality that the longer individuals live after they retire, the more their retirement costs their former employer. U.S. Census data show a marked increase in the life expectancy of Americans since the MPS retiree health insurance program was created in 1973, and there is no reason to suspect that increase has been any less for MPS retirees. Of equal if not greater importance are data that suggest that not only are MPS retirees living longer, but MPS teachers are also retiring earlier and are perhaps encouraged by MPS financial incentives to do so. The early-retirement years, those before the age of 65, are especially costly for MPS because those retirees are not yet eligible for the relatively less expensive Medicare-based health insurance programs, but must rather enroll in the higher-cost health insurance programs of the active employees.

Perhaps the most compelling argument for both workers and employers to save for retirement is the steady growth Americans have experienced in life expectancy in the last decades. As shown in the table below, average life expectancy of Americans has grown from 71.2 years in 1972, just before the retiree health benefit was established, to an estimated 78.5 years in 2010, according to the Census Bureau.11

Table 2

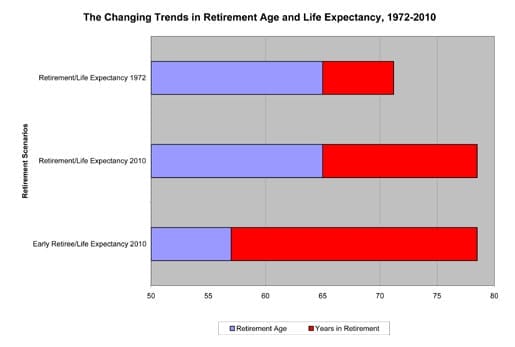

This overall increase in life expectancy is a relatively modest 10.3%. However, if one assumes a traditional retirement age of 65, post-retirement years increase from an average of 6.2 years (71.2 – 65 = 6.2) to an average of 13.5 years (78.5 – 65 = 13.5), a dramatic increase of 122%, more than doubling the number of years spent in retirement and, therefore, receiving retirement program benefits.

“Early” Retirement at MPS Is the New Norm

MPS retirement data from 2007 and 2008 clearly demonstrate that MPS teachers typically retire well before the traditional retirement age of 65. For 2007 and 2008, 91.4% of teachers who retired were under 65 years old; 65.6% of teachers who retired were under 60 years old. Only 8.6% of teachers who retired during that two-year period waited until they were 65 years old.12

Table 3

MPS Teachers’ Age at Retirement 2007 and 2008

| Age | # of Retirees | % of Retirees |

| <55 years | 6 | 1.80% |

| 55-59 years | 214 | 65.60% |

| 60-64 years | 78 | 32.90% |

| 65 and older | 28 | 8.60% |

| Total | 326 | 100% |

For 2007 and 2008, the average age of a retiring teacher at MPS was 57. This combination of increased life expectancy in the general population and making early retirement the norm for MPS teachers results in a significant increase in the number of years a typical MPS teacher may spend in retirement. As shown in Figure 1, the number of years between the traditional retirement age of 65 and average life expectancy was 6.2 years in 1972, the year before the health insurance benefit was established, and it will be 13.5 years by 2010. MPS teachers can expand the number of years in retirement even more by retiring early. The typical MPS teacher retiring at an average age of 57 can expect 21.5 years of retirement by the time he or she reaches normal life expectancy, as shown in the graph below.

Figure 1

To understand the implication of the above graphs depicting the number of years teachers could spend in retirement, it is important to consider this fact: an MPS teacher retiring at age 55 and living to a normal life expectancy of 78.5 could receive retiree health insurance benefits for 23.5 years, but would only need to have worked for MPS for 15 years to qualify for the benefits.

As shown in Table 4, 86.1% of MPS staff retiring in 2007 and 2008 were under the age of 65.

Table 4

MPS Retirements 2007 and 2008

Staff | Total Retirees | Retired Before 65 | % Retired Before 65 |

| Teachers | 326 | 298 | 91.4% |

| Administrators and Supervisors Council | 68 | 61 | 89.7% |

| All other MPS staff | 270 | 213 | 78.9% |

| 664 | 572 | 86.1% |

While the vast majority of MPS staff retiring in 2007 and 2008 did so prior to the age of 65, teachers and supervisors as a group retired earlier than other MPS staff. As shown in Table 5, the majority of teachers and supervisors retired between the ages of 55 and 59, while a plurality of all other staff retired between the ages of 60 and 64, closer to the traditional retirement age of 65 and first eligibility for Social Security benefits at age 62.

Table 5

Age at Retirement 2007 and 2008

| StaffBefore Age 5555-5960-6465 and olderTeachers1.8%65.6%23.9%8.6%Administrators1.5%72.0%16.2%10.3%Other MPS staff7.4%32.2%39.3%21.1% |

Early Retirements Drive Up Health Insurance Benefits Costs

Early retirements by MPS teachers and staff drive up the cost of the retiree health insurance benefit program in two ways. First, early retirees spend more years collecting benefits, adding to total costs. Second, and perhaps more important, health insurance costs for early retirees are considerably higher than for post-65-year-old retirees, who are eligible for Medicare. Early retirees are enrolled in one of the health insurance plans MPS offers to active employees, and MPS supplements their premiums at the rate it subsidized the highest-cost health plan at the time of the teacher’s retirement. For example, a teacher with single coverage retiring in 2007 would have been granted a lifetime monthly supplement of up $788.26, which was the amount of the MPS supplement for the PPO plan in 2007. The teacher would continue to draw the full $788.26 of the supplement as long as his or her monthly premium was the same as or larger than the maximum benefit.13

Table 6

Typical Premiums and Supplements 2007

| PPO Premium | MPS Supplement | Medicare Premium | |

| Single | $793.15 | $788.26 | $371.75 |

| Family | $1,753.48 | $1,741.63 | $908.60 |

On the other hand, if the teacher in our example was 65, he or she would be enrolled in Medicare, and the cost of the Medicare-based plan through MPS would be only $371.75 per month. MPS would pay the full premium, but still save more than half of the monthly amount it pays for teachers who retire before reaching 65. The savings are even greater for teachers and staff who have family health insurance coverage through MPS. In 2007, the MPS supplement would have been up to $1,741.63 for family coverage, whereas the costs under Medicare were only $908.60. In general, the cost to MPS for health insurance benefits to an early retiree can be approximately twice the costs of a retiree on Medicare.

Eligibility for Health Insurance Benefits

While it is evident that most teachers at MPS are taking retirement well before the traditional age of 65, high percentages of retiring teachers are able to meet the eligibility requirements for retiree health insurance benefits. While the Wisconsin retirement system, in which teachers participate, reduces pension benefits for those who retire early, there is no similar reduction in health insurance benefits by MPS for early retirees. Indeed, eligibility requirements for the retiree health insurance benefits appear to be set low enough that they may actually encourage early retirement. While some teachers contemplating early retirement may be hesitant to face the relatively high cost of private health insurance, the availability of the generous MPS subsidy to remain in the MPS health insurance programs surely makes the financial decision about whether to retire early or not considerably easier.

While it is not uncommon for employers to offer incentives to employees to limit their use of sick leave, it seems questionable whether MPS’s retirement benefits do so. While sick leave usage data are available from when the benefits was first granted, MPS staff indicate current sick leave use is not routinely aggregated for review and is not available. Nevertheless, the MPS board in the past did require annual sick leave use reports from staff, and those data are available from the late 1980s, allowing a comparison between sick leave use the year before the benefits were granted, and annual sick leave use more than 15 years later. In school year 1972-73, the average sick leave used by teachers was 6.91 days, compared to 7.44 days in 1983-84 and 7.06 days in 1988-89, the last year for which data are available. Average sick data, though limited, would appear to question whether the creation of the retiree health insurance program reduced sick leave use by staff, or reduced MPS costs for hiring substitute teachers to cover for employees on sick leave.14

However, since the required employment tenure to qualify for health insurance was reduced from 20 years to 15 years, and teachers were allowed to earn bonus sick leave days, it became easier for staff to qualify for the benefit. Consequently, a relatively high number of retiring teachers qualify for the health insurance benefit. Teachers could spend less than half of their teaching career at MPS and still qualify for lifetime health insurance benefits.

Of the 326 teachers retiring in 2007 and 2008, 77.3% received the health insurance benefit because they met all three criteria: 1) they were 55 years old or over; 2) they had at least 15 years’ experience at MPS; and 3) they saved 812 hours of sick leave.15 Teachers who meet the age and tenure requirements but fail to save enough sick days have the option of remaining in the MPS health plans, but paying the entire premium themselves. As shown in Table 7, 17 teachers chose to pay the full premiums themselves, and 19 teachers chose not to purchase MPS health insurance. Only 38 teachers were not eligible for the program under either the board-paid or self-paid options.16

Table 7

Teachers Eligible for Health Insurance Benefit 2007 and 2008

# of Teachers | % of Teachers | 55 | 15 yrs | 70% | Benefit |

| 252 | 77.3 | X | X | X | Board-Paid |

| 17 | 5.2 | X | X | Self-paid | |

| 19 | 5.8 | X | X | Declined Self-pay | |

| 38 | 11.6 | X | Not eligible | ||

Of the members of ASC (Administrators and Supervisors Council) who retired during the same period, 57 of 68, or 83.8%, also received board-paid health insurance benefits. However, as a group, the other MPS staff (staff excluding teachers and ASC) retiring during the same period were considerably less likely to attain eligibility for the full benefit. These other MPS staff are primarily clerical and technical staff, building trades and maintenance staff and food workers. Among other staff retiring in 2007 and 2008:

- 143 or 52.9% received board-paid health insurance benefits,

- 17 or 6.3% self-paid their entire premiums,

- 34 or 12.6% declined the self-pay option, and

- 76 or 28.1% were not eligible for the program.

Encouraging Early Retirement with Pension Sweeteners

In making the full retiree health insurance benefit program available to employees who chose to retire early, MPS provided a financial inducement for early retirement. Persons retiring at the age of 65 are immediately eligible for the federal Medicare program. However early retirees are faced with much higher costs for private health insurance, which can encourage workers to continue working until they are 65 and Medicare eligible. In the 1980s, a decade after initiating the retiree health insurance benefit, MPS created an additional inducement for teachers to retire early by providing supplemental monthly pension payments. This sweetener was designed to offset the penalty reduction made by the state to their state pension for retiring early.17 However, these pension sweeteners are also paid to MPS teachers who retire early, before the age of 65, who do not have their state pensions reduced. Teachers and other WRS participants with 30 years of service can retire at age 57 with no reduction in WRS pension benefits.

Employers sometimes use early retirement inducements, or pension sweeteners, as a short-term budget strategy to reduce salary costs. Employers wishing to reduce their workforce may offer a limited early retirement sweetener to select employees nearing retirement age to remove the higher-paid employees from the payroll. When costs of the sweeteners are more than offset by salary savings, such strategies can make economic sense for employers.

However, unlike employers who use limited-duration pension sweeteners on a selective basis for distinct financial advantages, MPS has instead instituted perpetual pension sweeteners for teachers choosing early retirement. This requires MPS to make not one, but two pension payments—one to the state retirement system and a second payment to MPS’s own supplemental retirement plan, which it administers itself. Not only does this second plan increase MPS’s pension costs, it provides an even greater incentive for teachers to retire early, thereby further driving up the cost of its retiree health insurance benefit program.

Beginning in 1982, the Supplemental Early Retirement Plan for Teachers was created as a single-employer defined benefit plan for teachers represented by the Milwaukee Teachers Education Association—MTEA. The purpose of the plan was to provide benefits to supplement the pension benefits teachers received through the state-operated Wisconsin Retirement System, which covers most state and local government employees and teachers in the state. The standard retirement age under the WRS is 65 for most employees (age 55 for protective service workers, such as state troopers), with some reduction in benefits for earlier retirement. The MPS supplemental plan actually provides two supplements to each qualifying teacher retiring early: 1) a permanent supplemental benefit for the life of the employee; and 2) a second, but temporary, supplemental benefit received by the employee until reaching age 65.18 The plan is entirely funded by contributions from MPS, with no contributions from teachers. A plan with a similar intent, called the Early Retirement Supplement and Benefit Improvement Plan, was established in 1978 for administrative, supervisory and professional staff of the district, and certain other designated employees. While MPS has made substantial pre-pay contributions to the early retirement pension plans, neither is fully funded. The plan for teachers has a funded ratio of 39% and unfunded accrued liabilities of $128 million, while the administrators plan is funded at 81% and has unfunded accrued liabilities of $10 million.19

Management Decisions Contributed to the Funding Deficits

It is clear that a series of MPS policy decisions contributed to increased participation in and, therefore, increased cost of the retiree health insurance benefits program, including:

- reducing the required years of employment with MPS from 20 to 15,

- allowing teachers to increase sick leave earned through incentive bonus days,

- encouraging teachers and administrative and supervisory staff to retire early.

While policy decisions clearly affect the costs of the program, questionable management decisions on how to budget for the program have directly led to the unfunded actuarial liability (UAL) of $2.6 billion. To put the problem in terms popularized by the nation’s current mortgage crisis, MPS has budgeted for retiree health insurance costs similar to a homeowner who takes out a home mortgage with no principal and artificially reduced interest payments for the first few years, but with a large balloon payment for all of the principal and most of the accrued interest later on. MPS’s version of the balloon payment is the $2.6 billion UAL.

To the average taxpayer, the language of budgeting for a billion-dollar-plus organization such as MPS, and especially the arcane, technical language of actuaries estimating the current value of costs to be incurred decades in the future, are almost impenetrable. Nevertheless, the fundamental principles for budgeting at MPS are as basic as for every taxpayer: make prudent spending decisions; don’t allow spending to exceed income; when promising to pay a large bill in the future that exceeds normal income and expenses, begin setting money aside, or make other sound provisions, to have the money available when the bill comes due.

Pre-Pay vs. Pay-As-You-Go Budgeting

It is generally agreed that the responsible way to budget for costs that will need to be paid once an employee retires is to pre-pay those future costs—to start saving money for those future retirement costs while the employee is still working, most preferably when the employee is first hired. The objective of pre-paying retirement costs while an employee is still working is to allow the savings to grow with interest and investment income over the years to an adequate amount to support the retirement benefit. Retirement costs, including pensions and health insurance benefits, can be paid entirely from those savings and their continued investment earnings. Therefore, once an employee retires, the benefit costs no longer need to be included in the employer’s annual operating budget. This is the method MPS follows in funding its pensions, including the primary pension system through WRS and the supplemental pension systems the district operates itself.

In contrast, MPS has chosen to use a pay-as-you-go, or paygo, method for funding retiree health insurance benefits. Under this method, no money is set aside during an employee’s working years. When employees retire, the costs of their monthly health insurance benefits must be factored into the annual budget. As such, these retiree costs are commingled with the costs of insurance premiums for all active employees and paid from salary and fringe benefits money in the annual operating budget.

Drawback to Paygo Budgeting for Retiree Benefits

There are several drawbacks to the paygo method. First, it can be up to three times more costly in the long term to taxpayers than a pre-pay approach. Payments from pre-funded plans, such as current pension plans, are made from a combination of taxpayer payments (which fund employer payments through payroll deductions) and long-term investment growth. When pre-payments are begun early and prudently invested, investment growth will ultimately be considerably larger than the sum of the payroll contributions. Staff at the WRS estimate that investment earnings may account for approximately 67% to 70% of the value of an individual’s pension account, compared to 30% to 33% due to payroll contributions.20 (When payroll contributions are funded jointly by the employer and the employee, the taxpayer-funded portion of pre-paid pensions is even less.) In contrast, the method chosen by MPS staff precludes any opportunity for investment growth and requires that all costs be borne directly by annual tax payments.

A second drawback to the paygo method is that including payments made for health insurance to retirees in the salary budget for operating expenses confuses the budgetary picture by making the cost of fringe benefits appear overly generous to active employees and by obscuring the actual cost of retiree benefits. For example, MPS spending on fringe benefits has risen to 68% of salary costs. MPS fringe benefit costs were found to be higher than for any of the comparison employers included in a 2008 survey of fringe benefits costs at comparable public and private employers conducted for MPS by Segal, a private consulting company.21 Health insurance spending accounted for 65% of all fringe benefit costs, and approximately 20% of MPS health insurance spending is for retirees.22

A third drawback to the paygo method is that it obscures the annual cost of the retiree health insurance benefit. Commingling the cost of retiree health insurance with that of active employees makes it difficult for most observers to understand exactly how MPS fringe benefit dollars are spent.

A fourth and, from a policy perspective, by far the most important drawback to the paygo method is that, by delaying the full costs of an employee benefit until years after it was originally enacted, it encouraged the MPS board to makes decisions on expensive benefit changes without having to feel the fiscal effect in annual budgets for years to come. In the case of the health insurance benefits, the real fiscal effect did not make itself evident, or burdensome, in annual operating budgets until a cohort of a generation of teachers moved through their careers at MPS and into retirement, and not until most if not all of the board members who voted for the benefit had left the board.

It is not surprising that the minutes of the board meeting in 1973 at which the teachers’ contract creating the new health insurance benefit was approved did not highlight the added costs of the new benefit. In the first year, and the first several years, the added costs would have been negligible because so few retirees would be in the program.

In an interview for this study, Michael Bonds, the current MPS board president, expressed concern over the increasing unfunded liability for retiree health insurance benefits caused by the paygo method, but indicated that the decision over how to budget costs is an MPS staff, not board, decision. Bonds indicated that to his knowledge the issue of the best funding method has not been brought to the board for discussion or for action.23 Prior to becoming board president, Bonds served as chair of the board’s finance committee.

MPS Has Ignored Past Warnings of Impending Cost Explosions

The current concerns and warnings about the huge unfunded liability for retiree health insurance costs is not the first time the problems have been spelled out to the MPS board. Twenty years ago MPS received a report from its then actuarial consulting firm that bluntly described the ever-growing financial problem being caused by the lack of pre-funding of the retiree health care benefit program. The first lines of the 1989 report are worth repeating because they so accurately, and in unusually clear language, predict the problem and explain the cause:

“The cost of medical coverage for employees and retirees has been the fastest-growing account within the school system. Current year pension costs represent approximately $40 million and medical costs represent approximately $28 million out of an approximate $565 million budget. At the current rate of increase, it will only be a few years before the annual medical costs exceed the pension costs. The escalation of the total medical budget has been caused primarily by two factors, medical inflation and the lack of prefunding these medical costs for retirees” (emphasis added).24

All that has changed from that warning 20 years ago is the size of the dollar amounts.

The changes in costs from those reported in the 1989 actuarial study to today are striking, and demonstrate how much faster the health insurance costs problem is growing relative to other parts of the MPS budget. The MPS total budget has somewhat more than doubled since 1989, growing from $565 million to approximately $1.2 billion; pension costs increased 84%, from $40 million to $74.5 million, and total health insurance costs (for active and retired staff) increased an incredible 658%, from $28 million to $212.3 million.25

While the 1989 actuarial report was clear in its call for MPS to take action and address the growing unfunded liability, the size of the problem, in relation to the overall MPS budget, was considerably smaller than it is today. In 1989, the estimated UAL was $202.6 million, approximately 36% of the district’s total operating budget of $565 million at that time,26, whereas 20 years later, the UAL had grown to an estimated $2.6 billion, approximately 216% of the district’s total operating budget of $1.2 billion.27 With hindsight, it would have been considerably easier to fix a problem that was just over one-third the size of the annual budget than a problem more than twice the size of the annual budget. MPS, however, chose neither to eliminate the UAL nor even to take action to keep it from getting any larger.

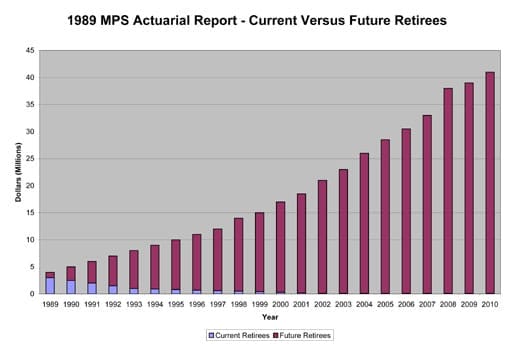

The 1989 report warned the MPS board that the size of the UAL would grow exponentially in coming years without action. The chart in Figure 2 below was included in the 1989 report and clearly demonstrated to the MPS board how costs could increase under its current paygo plan over a 21-year period. Retiree health insurance benefits in 1989 were approximately $4 million and were projected to increase to over $40 million by 2010.28

The consulting firm offered a number of possible funding options designed to contain the rapid future increases in costs that would result from the existing paygo method. Each of the options contained some degree of pre-payment of costs. The alternative recommended by the consulting firm was for the MPS board to establish a funding plan that would begin pre-paying future retiree health insurance costs and gradually, over a 30-year period, pay off the UAL. The annual cost of the proposed new funding plan was $20 million, compared to the $4 million for the then existing paygo approach. The consultants noted that, while the proposal would require a sharp initial increase in funding, the $20 million annually would remain relatively constant, while the paygo amount would increase annually and surpass the pre-pay amount within 15 years and continue to climb exponentially.29

The Personnel and Negotiating Committee of the MPS board accepted the consultant’s report at its September 1989 meeting and moved concurrence with the staff’s recommendation to hire another consulting firm and seek legal advice to develop a new funding vehicle for retiree health care costs.30 Nevertheless, despite the warnings and recommendations in the 1989 actuarial study and the recommendations of the board’s Personnel Committee, another actuarial report in 2007 demonstrates that the paygo funding method essentially remains and that the growth in the UAL is steeper than ever.

Financial reporting changes mandated by the Governmental Accounting Standards Board in recent years require large public institutions like MPS to begin recognizing their liabilities for retirement benefits such as health insurance benefits. As part of its compliance with these requirements, MPS contracted for an updated actuarial valuation, which was issued in November 2007.

Figure 2

That actuarial valuation documented that the UAL, which had been a relatively manageable $202.5 million, equal to approximately 36% of the district’s operating budget in 1989, had increased to an estimated $2.6 billion, equal to approximately 216% of the 2009 operating budget.31

While the new valuation report was presented to the MPS board in November, 2007, minutes of the meeting indicate the presentation of the report’s findings by the consultants elicited little comment. In fact, the report was introduced as an item for information only, requiring no action by the board. Supporting material provided by MPS staff to the board concerning the report stressed that the primary concern was how the credit rating agencies would eventually view the information disclosed under the new GASB reporting requirements.32 Beginning in 2008, MPS would be required to reflect on its balance sheet the cumulative shortfall in funding its annual required contribution, shown in Table 1, above. While the district is not currently required by GASB to include the UAL on its balance sheet, it must disclose the UAL in the notes to its financial statements.33

The MPS board was informed that while it was not known how the credit reporting agencies would react to the large balance sheet liabilities and UALs, it was anticipated that at some point, entities such as MPS would be expected to manage their liabilities with a combination of advanced funding and cost controls.34 In an interview for this study, approximately a year and a half after the board received the new valuation and estimates of the UAL, MPS President Michael Bonds indicated that any cost-control mechanisms that required benefit changes would, of course, be a matter of contract negotiations with MPS employee unions. He also indicated that to his knowledge there were no discussions or plans by the board to address the UAL or to reconsider the paygo method of funding costs.35 Given the opportunity to control or influence how the district would be viewed when credit rating agencies considered liabilities related to retiree health insurance benefits, the MPS board decided to do nothing and wait.

Incentives and Disincentives for Addressing the UAL

MPS staff warned the board in 2007 that credit rating agencies were likely, at some point, to expect entities such as MPS to pre-pay the funding of retirement benefits plans such as the health insurance benefits. However, despite these warnings, it would appear that from the board’s perspective, the disincentives to beginning to pre-pay for retiree health insurance benefits outweigh the incentives to do so.

Incentives

There are several sound policy and financial advantages to pre-paying retiree benefits costs. Perhaps the largest advantage is that, over the long term, costs to the taxpayers of Milwaukee would be considerably less than with the current paygo method. As noted above, for its pre-paid pension plan through the WRS, contributions (through taxes) account for only about one-third of pension payments, while the interest earnings and investment growth of those pre-payments account for the remaining two-thirds of pension costs.

Pre-funding future retiree benefits is also more equitable than MPS’s current paygo approach. Funds for the future costs are accumulated through regular payroll contributions for active employees while they are working, and earning, or “accruing” their future retirement benefits. Therefore, the costs associated with an individual employee, both when he or she is active and retired, are paid while the employee is working. Annual payroll costs clearly reflect just those costs associated with staff currently working for the district and can more readily be managed by adjustments to the size of the workforce, if necessary. Under the current paygo approach, however, an increasing percentage of the annual payroll budget is related to the health insurance cost of retirees.

A third advantage of pre-funding retiree benefit costs is that costs remain more stable and predictable from year to year rather than increasing exponentially as the number of retirees grows relative to the number of active MPS staff. MPS’s actuarial consultants have estimated that while the number of active employees is likely to remain at close to current levels in coming years, the number of retires will continue to grow. As a result, the ratio of active to retired employee will decrease from approximately 2 to 1 in 2007 to below 1.5 to 1 by 2016.36

Another advantage to pre-funding retiree benefits with the potential of financial implications is the improvement it would make to MPS’s balance sheet. As noted, recent changes to MPS’s financial reporting requirements now mandate that MPS show on its balance sheet the difference between the liability accruing (annual required contribution) for retiree benefits and the amount it actually is paying annually, shown in Table 1, which could reach over $350 million by 2016. In addition, while MPS is not currently required to include its entire UAL directly on its balance sheet, it must disclose the amount in the notes to its financial statements. Because these reporting changes are so recent, it is not known what effect they may have on MPS’s credit rating, which directly affects borrowing costs. A downgrade in the district’s credit rating would in turn increase district borrowing costs.

Disincentives

While the list of incentives for MPS to change its funding of the retiree health insurance benefits from a paygo to a pre-pay method is strong and includes factors such as lower overall taxpayer costs, the list of disincentives is equally formidable. That MPS has resisted the past warnings from its actuaries about the rapidly escalating UAL and recommendations to begin to pre-pay the retirement benefits is proof that the disincentives have proved stronger.

It may be impossible now to determine why MPS chose to use paygo when it first began the retiree health insurance program in 1973. By 1989, however, it appears that the immediate, sharp increase in the annual cost to convert to a pre-pay method may well have been the largest single factor dissuading MPS board members from making the change. Following the preferred option in the 1989 actuarial valuation report, costs for the retiree health insurance benefits would have increased from $4 million in 1989 to $20 million the following year, and remained at a steady $20 million. Because such a large portion of the annual $20 million payment would go to amortizing the UAL, it was estimated than annual costs under the existing paygo method, while increasing, would remain under $20 million for approximately 15 years, before the increasingly sharp upward exponential curve of the paygo costs exceed $20 million and rise to over $40 million in the next few years.

Today, the initial costs of converting to a pre-pay plan would be several times the magnitude of the 1989 costs. As noted in Table 1, the Annual Required Contribution when the most recent valuation report was issued was $175.5 million, while MPS was budgeting approximately $50.6 million. MPS would have been required to add nearly $125 million to begin pre-paying in the first year, with somewhat larger contributions each year thereafter. An additional $125 million would have required a 25% increase in the MPS payroll.

The political difficulties that the MPS board would face proposing to increase overall spending by over 10%, $125 million on a total budget of $1.1 billion, with none of the increase for student learning or program improvements, are hard to imagine. Even a more gradual transition from paygo to pre-pay, as outlined in one of the options in the 1989 valuation report, 37, would require tens of millions in new spending added to the district’s base budget.

Another disincentive to begin pre-paying retiree health insurance benefits is that funding for the first year of such a switch would not only require a significant increase in spending, but the increase would have to come entirely from local taxes. State equalization aids, which currently are more than twice the amount of property taxes,38 are calculated based on prior year expenditures. Consequently, it would not be until the second year of the increase in expenditures that state aid would begin funding a portion of the pre-pay expenses. Funding a $125 million increase for retiree health insurance benefits from the property tax levy is doubtful given that the entire property tax levy by MPS was approximately $251 million in 2008.39

In addition, because of the complex structuring of the state schools aids formula, a significant amount of new spending would likely not receive the amount of state support, even in the second year, that might be assumed. For example, in 2008, state support of shared costs for MPS was approximately 82%.40 However, a portion of MPS’s current per pupil spending level falls into what is called the tertiary aid level; any increases in spending are reimbursed at the tertiary aid level, which in 2009 was an estimated 43% for MPS.41 Each new dollar of spending would be aided at the lower rate.

Selecting a structure to house a pre-payment plan could pose another impediment to switching to the pre-pay option. The simplest form would be through the establishment of a separate fund or funds. However, if such a fund were established and grew significant balances, it could pose a temptation for future boards or administrations to borrow from the fund or to divert revenues for other purposes, especially in times of a district-wide fiscal emergency. Consequently, there could be significant opposition from some sectors within MPS to creating an internal fund for retiree health insurance benefits. Alternatively, a special trust could be established to collect pre-payments and provide retiree health insurance benefits. Such a vehicle would effectively prevent any possible diversion of funds for other purposes.

However, if ever there was reason in the future to dissolve the trust, resolving ownership issues of the holdings in the trust could pose complications. For example, no matter how unlikely it may appear today, if in the distant future the county adopted a government-funded health care system and MPS wished to dissolve the trust, ownership of the trust’s holding could be a contentious issue between MPS and the trust’s beneficiaries.

Borrowing funds to address the UAL for retiree health insurance, similar to how the district borrowed funds in 2003 to eliminate a UAL in its pension account, is an option. The district issued bonds for $168 million through the city and the city’s Redevelopment Authority to pay off its UAL with the WRS.42 However, the district’s UAL for retiree health insurance, at $2.6 billion, is over 15 times larger than the pension liability it had accrued, making bonding for such a large amount fiscally problematic. Bonding for a smaller amount to partially address the UAL would, of course, be proportionately less costly.

It would appear that if finding funds locally to begin addressing the UAL is beyond the capabilities of MPS without causing significant hardship to its students or taxpayers, the one entity that is large enough to provide such funding would be the state. However, some might argue that given the state’s precarious fiscal condition and the decline in state-wide tax revenues, it would be unrealistic to expect significant financial bailout from the state as long as governance of the district remains a local responsibility.

Potential Effects on Students

Perhaps the greatest disincentive to adopting a pre-pay method instead of the current paygo method is the potential negative effect it would have on the students of MPS. Any existing funds within the MPS current budget redirected to retiree health insurance benefits would be considered a reduction in the level of support for educational programs. Some could even argue that any new money that might come into the district to support retiree health insurance would represent money that could have been used for educational programs to help underachieving students.

It may be useful to consider just what $125 million, the amount of new funding needed in 2008 to begin to pre-pay retiree health insurance costs and to begin amortizing the UAL, means in relation to the MPS budget, especially to its direct costs for instruction. The following are FY 2009 adopted budget amounts, all funds expenditures. Not included are MPS expenditures for other school costs, such as MPS Alternative Schools and Charter Schools.43

- High schools $158 million

- Middle schools $50.0 million

- K-8 schools $266 million

- Elementary schools $181 million

Based on this comparison, $125 million in new funding for retiree health insurance benefits would equal 79% of the budgeted costs for all of the MPS high schools combined or would be more than double the 2009 budgeted costs of all MPS middle schools combined.

MPS business office staff have indicated that for informal budget estimates, their rule of thumb is that $1 million equals the full costs, including salary and fringe benefits, for 13 teachers.44 Using this shorthand estimate, the $125 million increase needed for retiree health insurance benefits translates into funding that could support 1,625 teachers. Conversely, a removal of $125 million from total compensation costs for active employees could result in a reduction of the same 1,625 teachers. The MPS 2009 adopted budget included a total of 5,928 full-time-equivalent teachers and therapists.

Using the same comparisons as above, 1,625 teachers compares to: 45

- High school teachers 980 Middle school teachers 374 K8 teachers 1584 Elementary school teachers 1,011

Based on this comparison, the number of teachers that could be funded with $125 million, the amount of the increase that would be needed for pre-pay funding of retiree health insurance costs, exceeds the total number of teachers at the MPS high schools, or the middle schools, or the K8 schools, or the elementary schools.

Conclusion

The magnitude of the difficulties that would need to be overcome in order for MPS to address its escalating fiscal problems in funding retiree health insurance benefits is clear even from basic comparisons of costs. The $125 million of new base, not one-time, funding that would need to be added to current amounts in order to fully fund the benefits is an overwhelming amount when compared to current direct expenditures on educational programs.

Nevertheless, opportunities for positive change exist. There have been a number of recent studies that would create operational efficiencies to reduce or at least contain costs. An extensive review of MPS operational activities and costs was conducted by large national consulting firm, McKinsey and Company, in 2009 to identify efficiencies and costs savings. That report built upon a large “benchmarking” study conducted in 2008 by a consulting firm hired by MPS, The Segal Company, which made detailed comparisons of MPS fringe benefits and their costs with a peer group of 33 other public and private employers chosen by MPS. The benchmarking study found that MPS fringe benefits were generally more generous than the peer group, and the study of operations concluded that with sufficient changes implemented over several years, MPS could realize between $58 and $103 million annually in cost savings.46

Subsequent to these reports, the governor, state superintendent of Public Instruction and the mayor of the City of Milwaukee created a seven-member MPS Innovation and Improvement Advisory Council in May 2009 to help guide what are hoped to be major changes at MPS.47 The membership of the council includes the mayor of Milwaukee and the MPS board president, demonstrating the high level of commitment and support enjoyed by the reform efforts.

Under the best of circumstances, the efforts to implement the recommendations of the recent reports and to spur additional innovation and improvements at MPS may yield substantial operational costs savings, even if they ultimately are somewhat below the $100 million projections in the McKinsey report. However, even these potential savings could be overwhelmed by the McKinsey report’s projections of deficits at MPS, which could approach $200 million.48

The quandary posed by MPS raises the question of how Wisconsin’s existing system for financing schools can possibly address something as overwhelming as MPS’s $2.6 billion UAL for retiree health insurance costs. Very large problems may require equally large solutions. However, mustering political support and the financial wherewithal for large solutions is challenging as long as doing nothing remains a viable alternative for the near term. Despite such challenges, it is important for Wisconsin policymakers to find solutions to seemingly intractable long-term financial problems because they may not exist solely at MPS. A 2008 report by the Wisconsin Policy Research Institute identified three other Wisconsin school districts with unfunded liabilities over $100 million and five more districts with unfunded liabilities of $20 million or more.49 As other districts begin to report their UAL, it is expected that other substantial unfunded liabilities will be exposed.

The UAL in retiree health insurance benefits had become a looming specter consuming an increasingly larger and larger share of annual payroll budgets at MPS and other local governments. The difficulty MPS has had in addressing its problems suggests the need to evaluate the adequacy of existing management and financing systems for local governments to address long-term systemic problems. Further, the size of the UAL at MPS raises questions about the adequacy of safeguards to prevent financial problems from going unaddressed until they reach such disproportionate levels relative to total budgets. As noted earlier, the MPS board and staff were warned 20 years ago that the UAL could grow to existing levels if corrective actions were not taken. However, there were no financial or accounting rules or guidelines to compel corrective action. In other words, the alarm bells went off, but the MPS board and staff were not required to answer.

There are a number of options that MPS and other Wisconsin policymakers can consider to: 1) slow the relentless growth of the UAL, 2) begin reducing its potential effect on future budgets, and 3) establish mechanisms to prevent fiscal problems from growing year after year to such an extent that they undermine or hinder MPS’s educational mission. Our recommendations include:

1. MPS should immediately and definitively move to implement the cost-saving recommendations of the McKinsey Report on district operations. This will demonstrate MPS’s willingness to make difficult, but necessary, fiscal decisions.

2. MPS should reduce the cost of health benefits offered by MPS through measures such as establishing greater cost-sharing requirements with employees and bringing the costs of its high-cost PPO plan more in line with its HMO plan.50

3. MPS should begin budgeting for the future health insurance costs of current employees in the same way it budgets for current employees’ future pension costs.

4. MPS should determine what changes can be made to reduce the cost of health care for current retirees within the framework that courts have placed on retiree benefit changes.

In addition to MPS-initiated changes, state government will likely play a role in crafting a solution. While MPS alone is responsible for creating its unfunded liability, the state constitution does assign responsibility for education to state government. As such, state government may be hard pressed to ignore the damaging effect the $2.6 billion unfunded liability could have on Milwaukee’s children. Therefore, we recommend:

- First, state government should establish limits on the amount of unfunded liability for retirement benefits such as health insurance that school districts could accumulate, similar to how the state currently limits school districts’ annual spending increases and debt levels.

- Second, state policymakers should consider whether there is a need for an increased state role in addressing specific local school issues like MPS’s unfunded liability.

*****

Endnotes

1Rivera, Alex and Williams, Amy, “Milwaukee Public Schools OPEB Valuation” (Gabriel, Roeder, Smith and Company, November 2007), 4. It should be noted that all references to the unfunded actuarial liability also include MPS’ liability for retiree life insurance premium payments, which in the Rivera study amounted to $63 million of the $2.2 billion UAL in 2007.

2Potential health care reforms at the national level could have an effect on future MPS costs.

3 Rivera.

4The Segal Company, “Milwaukee Public Schools Analysis of Fringe Benefits Survey” September 2008, 13. McKinsey and Company, “Toward a Stronger Milwaukee Public Schools” April 2009, 10-13.

5Encyclopedia for Business, “Employee Benefits”, website available at: http://www.referenceforbusiness.com/encyclopedia/Eco-Ent/Employee-Benefits.html

6 “Contract between The Milwaukee Board of School directors and The Milwaukee Teachers’ Education Association” (Teachers), January 1, 1973 to December 31, 1974. 10

7 “Contract between The Milwaukee Board of School directors and The Milwaukee Teachers’ Education Association” (Teachers), July 1, 2007 to June 30, 2009. 38-39, 61.

8Milwaukee Board of School Directors, “Meeting Minutes”, January 31, 1973”, 426.

9META, 2007 to 2009, 67-68.

10 Toth, Chris, MPS Staff, Interview with Don Bezruki, November 3, 2009.

11U.S. Census Bureau, Statistical Abstract of the United States: 2003. 27-28. U.S Census Bureau, Statistical Abstract of the United States: 2008. 74.

12MPS Provided Data, all Retirees, 2007 and 2008.

13Rivera, 13. 14Milwaukee Board of School Directors, “Meeting Minutes”, November 1973, 278, and October 1989, 57-60.

14Milwaukee Board of School Directors, “Meeting Minutes”, November 1973, 278, and October 1989, 57-60.

15The contract states that teachers must save 70% of the maximum of 145 sick days granted at full days, which equals 812 hours {70% [145×8] = 812}. Once teachers accumulate 145 days of sick leave, additional hours earned are banked at only half rate. META, 2007 to 2009, 38, 61.

16 “Retiree Counts by Eligibility, FY 07 and 08” MPS

17Rivera, Alex, Williams, Amy, Kivi, Michael, “Milwaukee Board of School Directors Supplemental Early Retirement Plan for Teachers” (Gabriel, Roder, Smith and Company, May 2008), B-1.

18“Milwaukee Board of School Directors Supplemental Early Retirement Plan for Teachers: Financial Statements and Schedules, June 30, 2008 and 2007” (Virchow Krause and Company, December 2008), 10.

18Nate, Michelle, “Comprehensive Annual Financial Report” (Milwaukee Public Schools, June, 2008), 73.

20Stohr, Matt, Department of Employee Trust Funds, Interview with Don Bezruki, October 8, 2009

21Segal, 25-27.

22McKinsey, 98.

23 Bonds, Michael, President, Milwaukee School Board, Interview with Don Bezruki, June 30, 2009.

24Wernicke, Mark, and Klug, Bruce, “Milwaukee Public School Report on Retiree Medical Benefit Liabilities” (Mercer, Meidinger, Hansen, Inc. August 1989), 1.

25Segal, 26-27.

26Wernicke, 1-3.

27Rivera, 4.

28 Wernicke, 19.

29Wernicke, 26.

30Milwaukee Board of School Directors Personnel and Negotiating Committee, “Meeting Minutes” Aug-Dec 1989, 7-8.

31Rivera, 4.

32The Milwaukee Board of School Directors Finance and Personnel Committee, “Meeting Minutes”, Nov. 20, 2007, 85-95, and attachment, 4-5.

33Ibid.

34The Milwaukee Board of School Directors, “ Meeting Minutes” November 29, 2007, 644.

35Bonds.

36 Ibid.

37Wernicke, 26.

38Nate, 90.

39Nate, 90.

40Lang, Bob, “2007-2008 Estimated State Support for School Districts” (Legislative Fiscal Bureau, August 21, 2008) B-1.

41The calculation of 43% is based on the formula and tertiary guaranteed valuation include in the LFB paper. Kava, Russ, and Merrifield, Layla, “State Aid to School Districts” (Legislative Fiscal Bureau Informational Paper 27, January 2009), 41.

42Nate, 54.

43“Superintendent’s Fiscal Year 2010 Overview” Milwaukee Public Schools, April 21, 2009, 45.

44Nate, Michelle, Chief, Finance and Operations, Milwaukee Public Schools, Interview with Don Bezruki, April 6, 2009.

45“Superintendent’s Fiscal Year 2010 Overview”, 32-33.

46Segal, 13, and McKinsey, 10.

47Doyle, Jim, Burmaster, Elizabeth, Barrett, Tom and Evers, Anthony, “Memorandum of Understanding:

Establishment of the MPS Innovation and Improvement Council” May 27, 2009.

48 McKinsey, 10.

49Schneider, Christian, “Government Retiree Health Benefits: Wisconsin’s Ticking Time Bomb” (Wisconsin Policy Research Institute, September 2008), 4.

50 While some changes may be possible only through collective bargaining negotiations, recent statutory changes to collective bargaining rules, including repeal of the Qualified Economic Offer (QEO), may increase bargaining flexibility in the future.